Update added 13/5/2024 Elon Musk Explains The Fed: Central Banking ‘For Dummies’

When I listened to this audio in January 2019, I was stunned. Not only did everything I thought of financially was just a con, I was too also grateful for Our Lady appearing and warning us, via Friend of Medjugorje wisdom / discernment.

David Ashton website owner

This article covers everything you need to know to take action.

Update 12 November 2022, view the latest Q posts.

Update 14 November 2022 view the latest X22 Report

Mel K & Author G Edward Griffin On Exposing The Creature From Jekyll Island 2nd July 2022

The Creature From Jekyll Island (by G. Edward Griffin) uploaded circa 2010 (date recorded unknown)

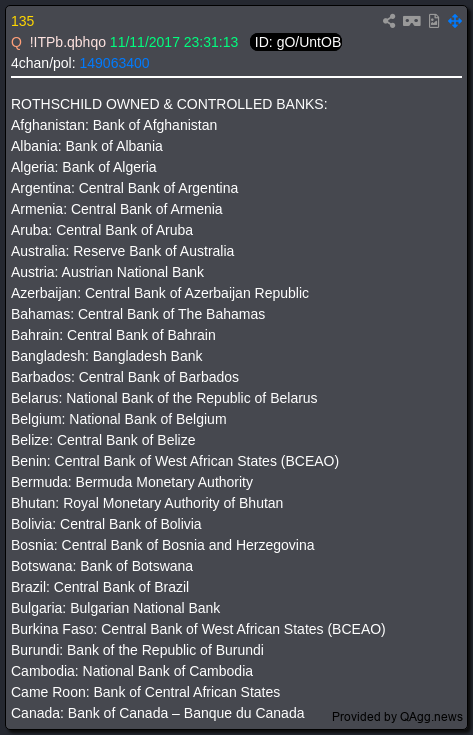

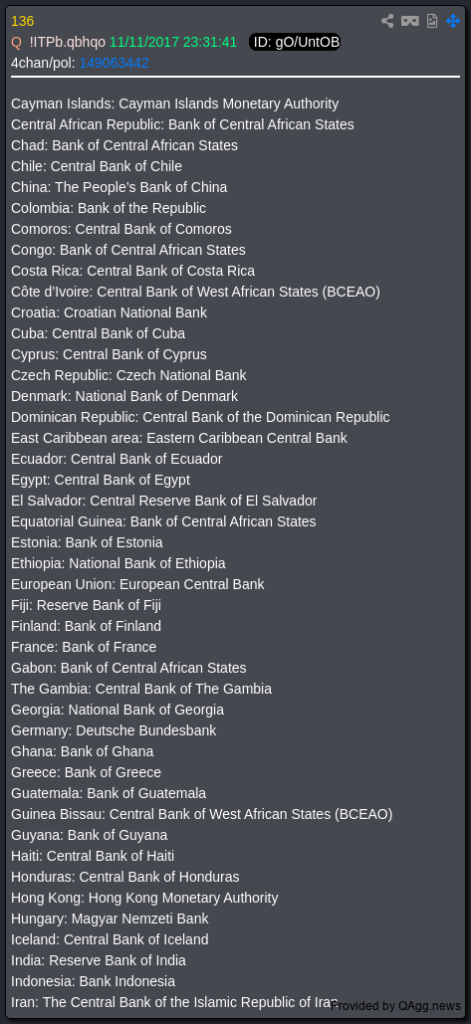

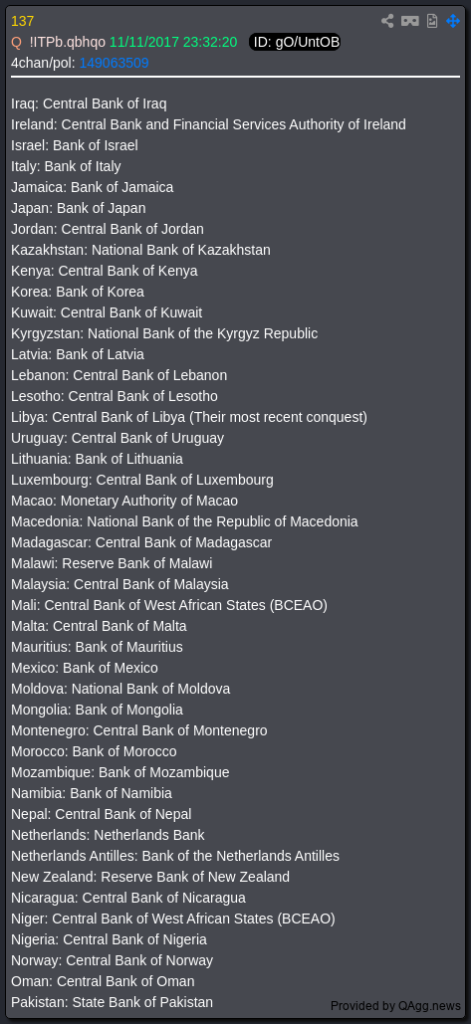

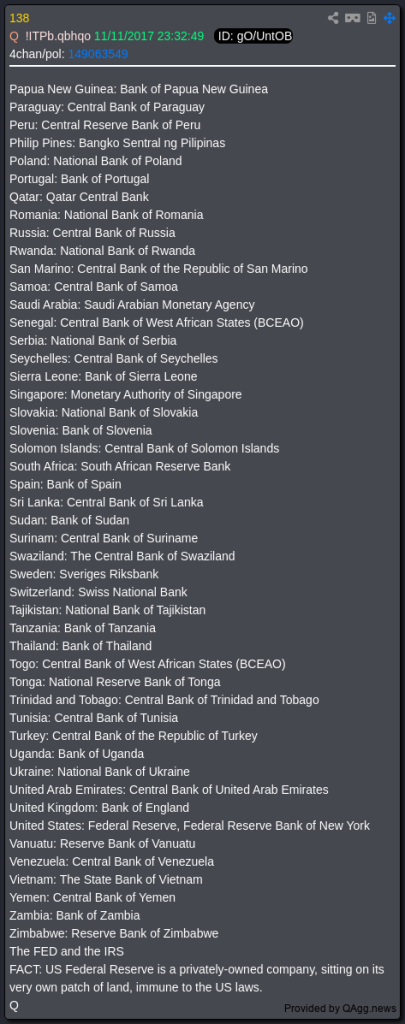

Q alerted us to the truth about the Federal Reserve Banks throughout the world too!

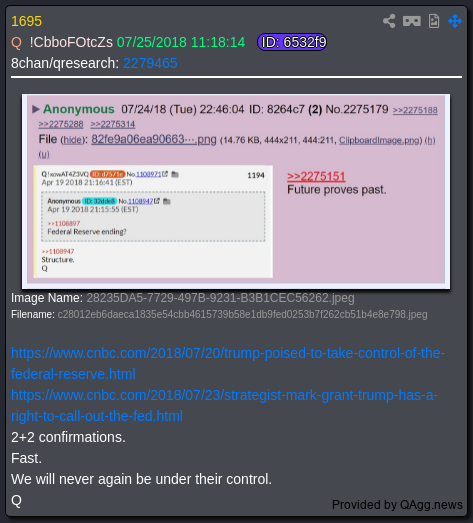

Links from q post #1695 followed by copies of the actual reports.

https://www.cnbc.com/2018/07/23/strategist-mark-grant-trump-has-a-right-to-call-out-the-fed.html

https://www.cnbc.com/2018/07/20/trump-poised-to-take-control-of-the-federal-reserve.html

Strategist Mark Grant: Trump has a right to call out the Fed if it’s not acting in the US best interest

PUBLISHED MON, JUL 23 20188:48 AM EDTUPDATED MON, JUL 23 20188:48 AM EDT

Berkeley Lovelace Jr.@BERKELEYJR

KEY POINTS

- President Trump has a right to call out the Fed if he feels the central bank is not acting in the best interest of the U.S., strategist Mark Grant says.

- In an interview with CNBC last week, Trump expressed frustration with the Fed’s recent move to raise interest rates.

- “The Federal Reserve bank does not represent the emerging markets or the European Union, it represents the United States of America,” Grant says.

President Donald Trump has “a right” to call out the Federal Reserve if he feels the central bank is not acting in the best interest of the United States, strategist Mark Grant told CNBC on Monday.

“The Federal Reserve bank does not represent the emerging markets or the European Union. It represents the United States of America,” said Grant, the chief strategist at B. Riley FBR.

“If [the government] feels like the Fed is not working within the policies of the United States government, they have a right to stand up and say something,” Grant added in a “Squawk Box” interview. “You have the Fed moving in the opposite direction of the government.”

Grant said to question the policies of the Fed does not interfere with its decisions.

In an exclusive interview with CNBC’s Joe Kernen that aired Friday, Trump expressed frustration with the Fed’s recent move to raise interest rates and said the central bank could disrupt the U.S. economic recovery.

Trump then criticized the Fed monetary policy again in a tweet Friday.

Fed officials, including Chairman Jerome Powell, have raised interest rates twice this year and have indicated two more are coming before the end of 2018.

Grant, who was previously managing director and chief strategist at Hilltop Securities, said he doesn’t agree with the central bank’s “return to normalcy.” He said if the Fed continues to raise interest rates, it will slow down economic growth.

“I don’t think the Fed should be raising interest rates at a time when Congress and the president under the Tax Cuts and Jobs Act is trying to grow the economy,” Grant said.

—CNBC’s Jeff Cox contributed to this report.

Dick Bove: Trump poised to take control of the Federal Reserve

- President Trump sharply criticized the Federal Reserve this week, saying interest rate increases are hurting the economy.

- Trump will have the opportunity to fashion the central bank in the image he would like as he has four vacancies to fill on the board of governors.

- The result could be a more politicized Fed.

President Donald Trump has multiple reasons as to why he should take control of the Federal Reserve. He will do so both because he can and because his broader policies argue that he should do so. The president is anti-overregulating American industry. The Fed is a leader in pushing stringent regulation on the nation. By raising interest rates and stopping the growth in the money supply it stands in the way of further growth in the American economy.

First, He Can

The Board of Governors of the Federal Reserve is required to have seven members. It has three. Two of the current governors were put into their position by President Trump. Two more have been nominated by the president and are awaiting confirmation by the Senate. After these two are put on the Fed’s board, the president will then nominate two more to follow them. In essence, it is possible that six of the seven Board members will be put in place by Trump.

The Federal Open Market Committee has 12 members and sets the nation’s monetary policy. Seven of the 12 are the members of the Board of Governors. Five additional are Federal Reserve district bank presidents. Other than the head of the Fed bank in New York, who was nominated by the president, the other four can only take their positions as district bank presidents if the board in Washington agrees to their hiring. One of these, the Fed Bank president in Minneapolis, Neel Kashkari, is already arguing for no further rate increases.

Trump: I don't necessarily agree with raising rates

President Donald Trump has multiple reasons as to why he should take control of the Federal Reserve. He will do so both because he can and because his broader policies argue that he should do so. The president is anti-overregulating American industry. The Fed is a leader in pushing stringent regulation on the nation. By raising interest rates and stopping the growth in the money supply it stands in the way of further growth in the American economy.

First, He Can

The Board of Governors of the Federal Reserve is required to have seven members. It has three. Two of the current governors were put into their position by President Trump. Two more have been nominated by the president and are awaiting confirmation by the Senate. After these two are put on the Fed’s board, the president will then nominate two more to follow them. In essence, it is possible that six of the seven Board members will be put in place by Trump.

The Federal Open Market Committee has 12 members and sets the nation’s monetary policy. Seven of the 12 are the members of the Board of Governors. Five additional are Federal Reserve district bank presidents. Other than the head of the Fed bank in New York, who was nominated by the president, the other four can only take their positions as district bank presidents if the board in Washington agrees to their hiring. One of these, the Fed Bank president in Minneapolis, Neel Kashkari, is already arguing for no further rate increases.

Trump’s comments on the Fed were a big deal. Here’s why

Second, Regulation

Following the passage of the Dodd Frank Act in July 2010, the Fed was given enormous power to regulate the banking industry. It moved quickly to implement a number of new rules. The Fed set up a system that would penalize banks that failed to obey its new rules. These rules included setting limits as to how big an individual bank could be; how much money the banks had to invest in fed funds and Treasurys as a percent of their assets; which loans were desirable and which were not; where the banks had to obtain their funding and many, many, more up to and including how much a bank could pay its investors in dividends.

These rules have meaningfully slowed bank investments in the economy (the Volcker Rule) and they have had a crippling effect on bank lending in the housing markets (other agencies have had an impact here also).

Thus, of all of the government agencies the Fed has been possibly the most restrictive. The president has already moved to correct these excesses by putting in place a new Fed Governor (Randal Quarles) to regulate the banking industry.

Three, Killing Economic Growth

In the second quarter of 2018, the growth in non-seasonally adjusted money supply (M2) has been zero. That’s right, the money supply did not grow at all. This is because the Fed is shrinking its balance sheet ultimately by $50 billion per month. In addition, the Fed has raised interest rates seven times since Q4 2015. Supposedly there are five more rate increases coming.

This is the tightest monetary policy since Paul Volcker headed the institution in the mid-1980s. It will be recalled his policies led to back-to-back recessions. Current Fed monetary policy is directly in conflict with the president’s economic goals.

Moreover, the Treasury is estimating it will pay $415 billion in interest on the federal debt in this fiscal year. A better estimate might be $450 billion if rates keep going up. There are a lot of bridges and tunnels and jobs that could be created with this money.

Then there is inflation. It is likely to rise if the Fed eases its policies. If that happens paying down the federal debt becomes easier. On a less desirable note, higher interest rates lower real estate values. Lower rates that stimulate inflation increase real estate values.

Bottom Line

The president can and will take control of the Fed. It may be recalled when the law was written creating the Federal Reserve the secretary of the Treasury was designated as the head of the Federal Reserve. We are going to return to that era. Like it or not the Fed is about to be politicized.

Richard X. Bove Financial Strategist at Odeon Capital Group

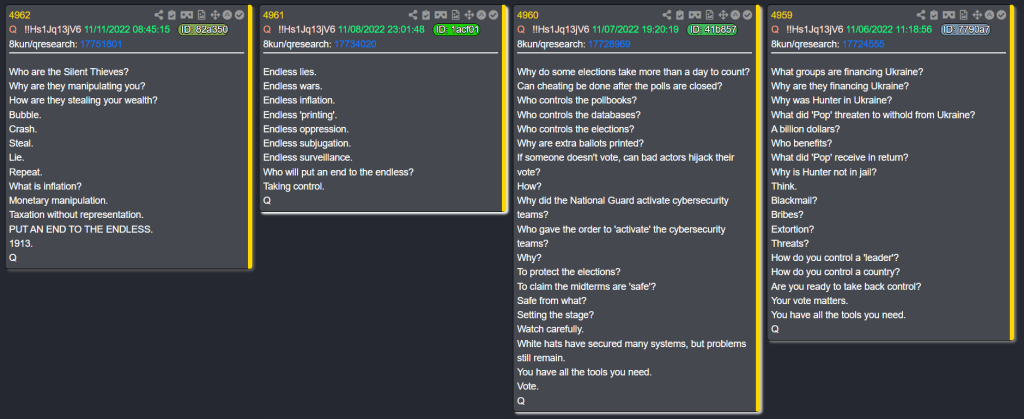

Q latest 4 posts up to 11 November 2022

Why did I place a copy of Q's latest posts here today? Read 4962 and take note of the date 1913. If you have listened to the above audio you will know why.

X22 report from 14 November 2022

This report will bring everything together for you. The past and present explained. The [CB] is using the same playbook that they used in 1933 to control the gold market and they are now using it to try to control the Bitcoin. This will fail. The people around the world are watching, the economy is falling apart and they know who is responsible for it. The world is watching.

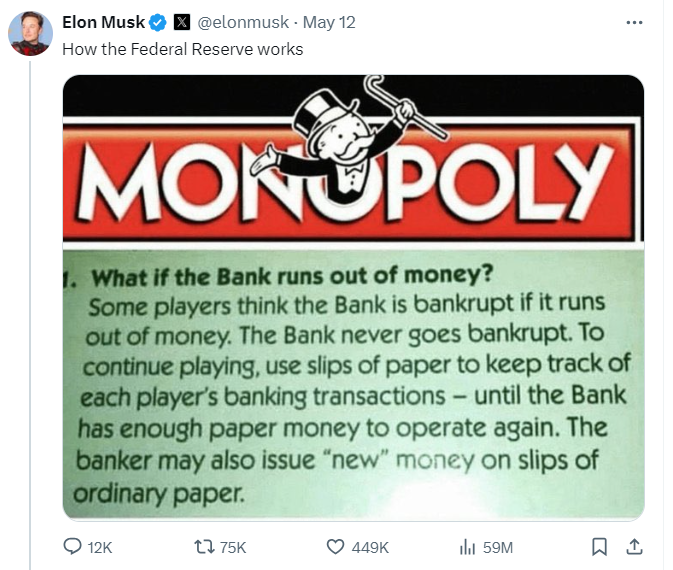

Elon Musk Explains The Fed: Central Banking ‘For Dummies’

It was always right there.

Hiding in plain sight.

Right under our noses every time we played the simply game of Monopoly.

It’s almost like they were mocking us. ‘We have the monopoly on money and we don’t. Deal with it.’

This was brought to the attention of 31,000,000 people via Elon Musk’s post on X.

He simply stated how the Fed works.

They never run of money because they print however much they need.

The Heritage Foundation, an activist American conservative think tank, wrote a piece about this not long ago:

Every major economic downturn of the last 110 years bears the mark of the Federal Reserve. In fact, as long as the Fed has been around, it has swung the economy between inflation and recession. Yet Americans, surprisingly, have tolerated it.

But we shouldn’t expect that to go on forever. We had three central banks before the Fed and confined each to the ash heap of history. The problems inherent to central banking are cause to scrap the Fed as well.

Central banking dates to 1694, when the Bank of England was founded for the purpose of creating the hidden tax of inflation to provide cheap money to government—above all, for Britain’s many foreign wars. In exchange, the central bankers were paid well with interest.

Like any government-favored bank, the Bank of England lent money it didn’t have, lending far more than the silver in its vaults. The British government endorsed this fraud because the king and Parliament wanted the money.

But the fraud went further still: The Bank of England was allowed to use its new government bond holdings to back private loans, which meant creating even more money with no silver behind it to lend to private banks. This, too, earned interest, even though the money was created out of nothing.

The explosion of money caused a tissue fire in the British economy—a short period of fast growth followed by rampant inflation and an economic collapse. The boom-bust cycle was born, what we now call the “business cycle.”

When the Bank of England didn’t have enough silver to exchange for all the money it created, the British government pulled the 18th-century equivalent of a bailout by suspending specie redemption, allowing the Bank of England to stop repaying in the silver it had promised.

Central banking was imported to the New World before the Constitution was even written. The Bank of North America, our first central bank, copied the Bank of England and created hyperinflation under the Articles of Confederation. At that point, the Founding Fathers scrapped both the Articles and the bank.

Thinking that the bank needed a replacement, Congress created the First Bank of the United States in 1791 to consolidate the various currencies and debts from the states and to provide short-term loans to the government.

The First Bank was forbidden from buying government bonds to avoid its predecessor’s hyperinflation. But when the government needed more revenue, Congress decided to sell its shares in the bank, and the charter wasn’t renewed. The central bank was dead, and the U.S. economy boomed until the War of 1812.

To finance that war, the government borrowed heavily from regional banks, which created money out of nothing for the government. That meant that much more paper money was in circulation than gold and silver in bank vaults. When people tried to redeem their paper for specie, the banks didn’t have enough, and many failed.

To bail out the banks, Congress created another central bank in 1816, the Second Bank of the United States.

The Second Bank curtailed excessive lending by regional banks, but only after first encouraging it. The result was a debt-fueled boom followed by a bust in 1819 that sparked the nation’s first depression.

Many in Congress were tolerant of the violent economic spasms caused by the central bank because it provided money for them to spend without overtly raising taxes. But the people were not fooled and would not tolerate it. They elected Andrew Jackson to do battle with the beast, and he ensured the bank’s charter wasn’t renewed in 1836.

That ushered in some of America’s greatest decades of economic growth.

The Golden Age came to an end in 1907 when mismanagement by major banks touched off a bank crisis that required a herculean rescue effort by J.P. Morgan and Co. In response, J. Pierpont Morgan wanted the government to sanction a private “bank for bankers” to respond to such crises.

I’ll let ChatGPT explain what happened right after that:

The Federal Reserve System, often referred to as the Fed, was established on December 23, 1913, with the signing of the Federal Reserve Act by President Woodrow Wilson.

The Federal Reserve Act created a central banking system. The Fed was established as a decentralized network of regional Reserve Banks overseen by a Board of Governors in Washington, D.C. Its primary objective (was control. – Me)

Ever hear the story about the group of men that were opposed to the creation of the Federal Reserve?

All of them just happened to take a one way trip on a new luxury liner in 1912. The Titanic.

It’s almost like it was planned to remove opposition.

But where would they get an idea like that from?

A book from 1898?